|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

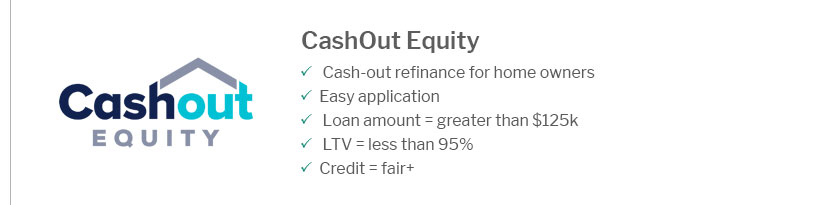

Understanding Home Equity Loan Options in Rhode IslandHome equity loans are a popular choice for homeowners in Rhode Island looking to leverage the equity in their homes. This guide provides insights into how these loans work, their benefits, and key considerations for potential borrowers. What is a Home Equity Loan?A home equity loan allows homeowners to borrow against the value of their home. Essentially, it's a second mortgage that lets you convert home equity into cash. These loans are often used for large expenses like home improvements, debt consolidation, or educational expenses. Benefits of Home Equity Loans

Qualifying for a Home Equity Loan in Rhode IslandTo qualify, you generally need to have sufficient equity in your home, a good credit score, and a stable income. It is advisable to check current home loan approval criteria for more precise requirements. Steps to Apply

Risks and ConsiderationsWhile home equity loans can provide financial flexibility, they also come with risks. If you default on the loan, you risk losing your home. It's crucial to consider your ability to make consistent payments over the loan term. FAQs About Home Equity Loans in Rhode IslandHow does a home equity loan differ from a HELOC?A home equity loan provides a lump sum with fixed interest rates, while a HELOC offers a revolving credit line with variable rates. Can I refinance my home equity loan?Yes, you can refinance to take advantage of better terms or lower rates. It's wise to check current mortgage refinance interest rates forecast for the best timing. What fees are associated with home equity loans?Fees can include appraisal fees, origination fees, and closing costs. It's important to review all potential charges with your lender. In conclusion, a home equity loan can be a valuable financial tool for Rhode Island homeowners, provided they carefully assess their financial situation and understand the terms involved. https://www.peoplescu.com/personal/mortgage-and-home-equity-loans/home-equity/

A great way to finance home improvements, education or medical bills. Our home equity loans come with a fixed rate and multiple terms. https://www.banknewport.com/personal-banking/borrow/home-equity-loans/

Minimum loan amounts are subject to change without notice. Subject to credit approval. Maximum APR is 21% in RI, 18% in MA, and 12% in CT. Fees will apply if ... https://www.ricreditunion.org/lending/home-equity-loans/

Great option to help you benefit from the equity you've earned. APPLY NOW Use the equity in your home for home improvements, debt consolidation, travel or ...

|

|---|